Billing Rates¶

While warehouse services are codified in legal and contractual terms, the warehouse services are priced for a customer through a Rate Quote. In addition to pricing services, WARES rates provide the mechanics of capturing services and billing the customer for them. Entering rates requires considering both the pricing aspect of rates and the application of rates to warehouse activity.

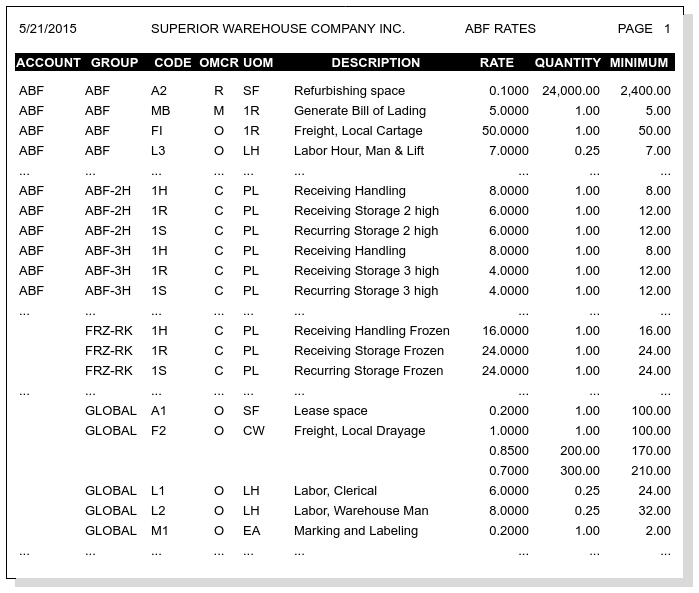

Rate Quotation Report¶

A Rate Quote shows the customer services being offered and charges to be billed for those services. Further, it guarantees the logistics company that they will be fairly compensated for services rendered. Knowing the information in a rate quote is crucial before entering rates. The WARES Rate Quote displays a table of the following columns:

| Heading | Description or Explanation |

|---|---|

| Account | Customer Account Identifier |

| Group | Groups organize Rates for management |

| Code | Service Code identifies each service offered by company |

| OMCR | Applied (O)ptional, (M)andatory, (C)alculated, (R)epeating |

| UOM | Billing unit of measure (UOM) code for quantity |

| Description | Invoice/Billing Description of the service |

| Rate | Nominal Rate per unit quantity of service |

| Quantity | Quantity level corresponding to the rate |

| Minimum | Minimum charge applied for this service |

Example of Quote Sections¶

An example partial rate quote is shown following to demonstrate how rates are presented to the customer with WARES. There are four sections to the report, determined by entries in the Account and Group columns.

Sec. 1: Private Rates by Account¶

ACCOUNT = ABF, GROUP = ABF:

Rates grouped by the account identifier (ABF) appear first on the quote. When entering rates in an account group, the account entry, ABF in this case, will be automatically filled and protected. These rates are private to the account, and a service code listed in this group will override a corresponding rate in the general group GLOBAL.

Sec. 2: Private Rates by Group¶

ACCOUNT = ABF, GROUP = user-defined:

Other groups which are restricted by the account identifier provide multiple rate sets for an account, particularly for calculated storage and handling. If an account identifier is entered on the first rate in a group, the account is added and protected on all rates in the group.

Notes on Quotes Example¶

- In the example report, the GLOBAL section shows Codes L1 and L2. The code L3 appears in the private account group ABF, and so this code is suppressed in group GLOBAL for customer ABF.

- Codes 1H, 1R, and 1S are used in both private groups for ABF and the shared group FRZ-RK. Codes used in private groups do not override the same codes in shared groups.

- GLOBAL rate F2 is a tiered rate. The amount charged per unit depends on the quantity, as described in Section 3: Rate Tiers.

Rates Entries¶

In addition to the Rate Quote entries, WARES needs the activity information which triggers a mandatory charge, the conversion of activity quantities into billing units of measure, and the calendar for a repeating rate. The full information for a rate can be broken down into three sections: the scope for applying a rate, the rate calculation and display, and the repeating calendar. This section details these rate parts.

The RATES Data Table Columns may be viewed here for information.

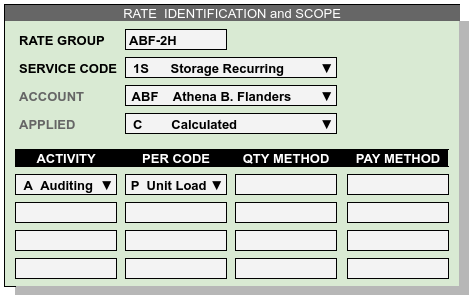

Rate Identifying Scope¶

Rates are identified by the Rate Group and the Service Code. All Rates belong to some group, and groups are either shared across all accounts or are assigned to one account, linking the group’s rates directly to the account.

While the Service Codes define the type of service offered, they also determine the manner of applying a service. For example, service codes which are applied Repeating and Calculated cannot be used with rates in group GLOBAL, as GLOBAL contains Optional rates only.

Similarly putting Mandatory or Repeating rates in a group which is not associated to an account is possible, but not recommended. For example, if every account receives the same charge for say, Bills of Lading, then a shared group without an account could include the Mandatory Bill of Lading service. But: entering a rate with the same service code in an account group would result in two charges, because account-associated rates override GLOBAL rates, but not rates in other shared groups.

The following figure shows identifying entries for rates:

Rate Activity Scope¶

Rates link to warehouse activities through a list of activity codes, where each activity uses a Per code to convert activity quantity units into the rate’s billing units. When a rate is associated with an activity list, the rate is restricted to only that list of activities.

Note

Where a standard per code cannot return a usable quantity, or if the payer of a charge is not the account, then custom program methods may be required. Optional method entries are provided to enable these custom features.

Rules Regarding Rate Scope¶

A rate record identifies how to use a warehouse service code when applying charges to an account. Rules which determine how to apply rates follow:

- Either a rate is restricted to a single account, or it is shared with all accounts, depending on whether the Account entry is filled.

- All rates in a group must have the same account entry. When one rate in a group is associated with an account, all rates in the same group must be filled with the same account as well.

- An optional rate may be restricted to one or more activities, or it may be applicable to all activities.

- All rates which are not optional must be associated with an activity so that the rate can be calculated to produce charges.

- Rates in an Account group override GLOBAL rates for the same service.

Additional Rates Properties¶

- Any one service code can appear only once in a group.

- Optional rates are charged through user entry, and all other rates are charged by system routines.

- Rates in the GLOBAL group are always Optional.

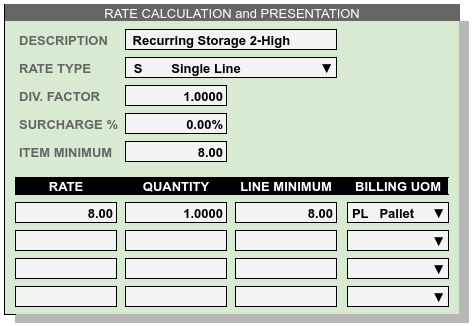

Rates Calculation¶

Rate calculation entries determine the content of charge line detail.

| Entry | M | Billing Information Entry | Default |

|---|---|---|---|

| Description | M | Information shown on charges and invoices | (code) |

| Rate Type | M | Rate types: Single, Quantity, Measure, or Tier | S |

| Factor | M | Numerical quantity divider for unit conversion | 1.0 |

| Surcharge | Percentage charge multiplier for tax or other | null | |

| Item Minimum | Minimum total charge amount on an activity | ||

| Rate | The service charge per unit at quantity level | ||

| Quantity | M | Starting quantity to apply this rate level | 1.00 |

| Line Minimum | Minimum amount for charge entry at level | Q * R | |

| Billing UOM | M | UOM used on charges and invoices at level |

- The rate Description entry is the actual invoice description for calculated, mandatory, and repeating charges. This is the default charge description for user-entered optional charges.

- Rate Type sets whether the rate will have a (S)ingle line, or if multiple rates form a table based on either (Q)uantity or (M)easure, or if a rate has (T)ier levels with corresponding minimums and rationality checks.

- A Factor will divide the quantity in a charge to convert from inventory quantity to billing quantity. For example, the factor 100.00 converts inventory unit LB into billing unit CW (hundredweight).

- A Surcharge percentage may apply to a rate to cover services taxes, fuel surcharges, or other items. This is a percentage, not a decimal value.

- An Item Minimum can be applied to an entire transaction to result in charges that are reasonable. For example, a handling charge of $.40 per case is not reasonable when receiving a single case.

- The Billing UOM (unit of measure) prints on charges and invoices to describe the units of a charge quantity.

The rates portion of an entry is tiered by quantity or measure, so that rates can increase or decrease as quantity increases.

- Where a Rate for a particular charge is variable, the Rate field may be left blank and entered manually each time the charge is applied.

- The Quantity defaults to 1.0. Quantity entries are required.

- A Minimum value for resulting charges defaults to Rate times Quantity. This minimum would be applied to every transaction line.

See Extending Rates to Charges for a detailed explanation of rate calculations.

Rates Setup Considerations¶

Before any rates are entered, decide what services are being offered and what the default, or retail, rates are for those services. When defining a list of services, do not over-generalize. For example, do not lump all labor services into a single heading, when they can be broken down into specific activities such as RESTACKING, PACKAGING, RELOCATING, and so forth.

Global Rates: Once business services are identified, enter a rate in group GLOBAL for each optional service using the highest rate charged.

Override Rates: Group negotiated rates on each account under the account identifier, using the same service codes as in group GLOBAL. These negotiated rates will override default global rates for a service.

Mandatory Rates: GLOBAL rates are only optional. Where a transaction always generates a charge, enter a rate for the service in the account’s group with Apply set to Mandatory.

Repeating Rates: When a charge is not based on a transaction, but is applied periodically instead, the rate for the charge should be made Repeating. A Calculation Calendar is required for calculating every repeating rate.

Calculated Rates: Special billing calculations are necessary to determine charges for rates which are based on properties beyond the amounts of a transaction. Warehouse storage and handling charges depend on product characteristics, and these rates are calculated accordingly. Each product master record identifies the rate group specific to that product.