Transaction Charges Auditing¶

Applying rates to activities results in charges, which are recorded on charges records for later consolidation into invoices. Charges have a standard format which simplifies auditing an invoice. The reportable information of a charge is either informational description, or presents the charge calculation details.

Detailed Charge Reporting¶

WARES maintains charge information at a detailed level so that charges and invoice amounts are accurate and trustworthy. This detail means that for inventory amounts, charge calculation is based on units, if units are tracked, or lots when tracked, or products when lot numbers are not used. Other charges may be tracked by the individual transactions of an activity, such as one or more document charges for each shipment.

Descriptive Charge Entries¶

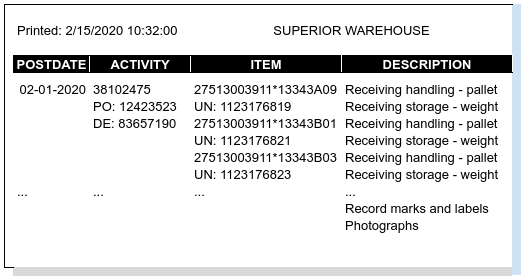

Descriptive information on a charge audit report consists of:

- the activity Date,

- the Activity transaction number,

- any Item information such as product codes,lot numbers or unit numbers, and

- the Description of the charge.

These entries are illustrated in the following left-side CHARGES DETAIL report sample which shows charges from a warehouse receipt.

Charge Calculation Details¶

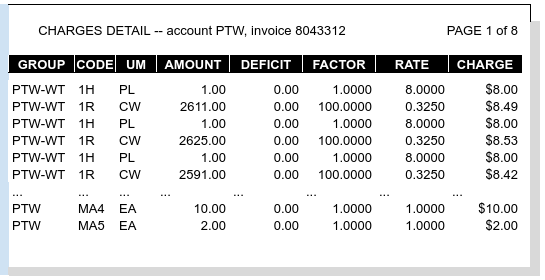

Each charge results from the following entries:

- The Rate Group and Service Code entries used, part of the contract Rate Quotation Report for the customer,

- A billing unit of measure (UOM) describing the charge’s amount basis,

- The calculation of the charge quantity, consisting of Amount, Deficit, and Factor,

- The published Rate from the customer’s rate quote, and

- The calculated Charge.

The right-side CHARGES DETAIL report sample, showing these receiving charges, is presented here.

Summary Charges Reporting¶

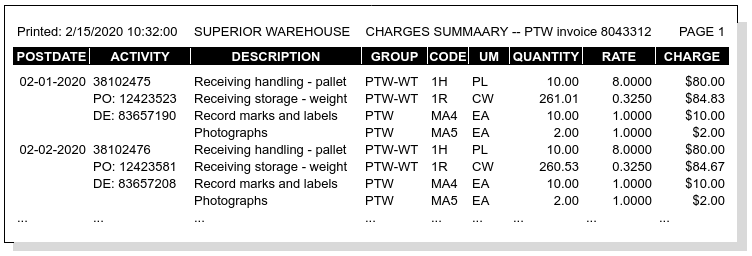

Auditing an invoice amount requires examinimg the supporting detail. Detailed audit reports can be quite large, and so a CHARGES SUMMARY report presentation will reduce the volume of information.

The CHARGES SUMMARY presents the Quantity which is calculated from Amount, Deficit, and Factor by the formula:

Quantity = ( Amount + Deficit ) / Factor

Then individual rate codes are summed by Activity to eliminate itemization. An example SUMMARY CHARGES report follows.

Where fractional charges are summarized, the addition of charges rounded to the nearest cent may result in (slight) inconsistencies if Quantity*Rate is extended to recalculate the total charge on a line. This might happen for the hundredweight-based storage charge, for example.

Detailed Charges by Code¶

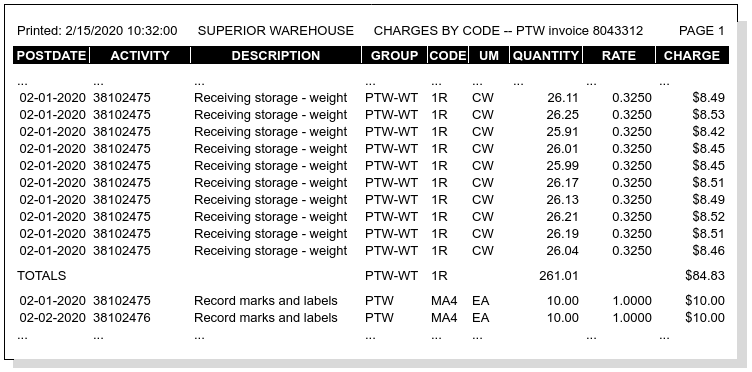

The invoice is organized by Rate Group and Service Code, while the previous reports are arranged by activity transaction. This makes auditing onerous, so an alternative CHARGES BY CODE report is available.

This report has the same depth as the CHARGES DETAIL, while displaying the columns of the CHARGES SUMMARY. Each TOTAL on the report matches one line item on the invoice.

Charges Transactions Columns¶

Here is a link to the CHARGES Lines Data Columns schema.