Defining Rates for Charges¶

Rate Overview¶

Rate records define charges for the warehouse services which are invoiced to customers. A charge cannot be applied to an activity, a transaction, or a bill without a rate record defining the charge.

WARES rate definitions allow a company to bill all types of services according to standard industry practices. When writing a proposal or contract, enter proposed rates here to verify that the quote will be consistent with industry norms and can be implemented as intended within the WARES software.

Warehouse services are defined by the company Initial Service Code List. Each rate relates to eactly one service code.

Scope and Grouping of Rates¶

Rates are grouped and the type of group affects the scope of a rate. Any one service code can appear only once in a group. All rates in a group will have the same account entry. If the account entry is left blank on a rate group, those rates can be applied to any account. If the account entry is filled, the rates will be restricted to the specified account.

Many rate records may refer to the same service code, and an account may have more than one rate for a service, provided the rates are in separate groups.

- Rates in the GLOBAL group apply across all accounts, and the account entry for GLOBAL rates is null and protected. The GLOBAL group sets default rates for the company.

- Rates gouped by account identifier apply to only one customer account, and the account entry of these rates is filled with the account identifier and protected.

- Rates may be assigned a group code other than an account identifier or GLOBAL. The account entry, which may be null, must be the same for all rates in the group.

A group rate for a service will override a corresponding GLOBAL rate with the same service code, and account-associated rates and groups will override rates which are not assigned to accounts.

Grouped rates are particularly inportant for calculated charges, specifically storage and handling. As an example, there should be different storage rates for cartons on pallets stacked 3 high than for supersacks stacked 2 high. This would require two separate rate groups associated with the account. Typically each rate group would include the calculated storage and handling service codes for a group of products which are billed the same.

Another warehouse stores imported Boxed Boneless Beef. These goods are brokered or traded while in the warehouse, so product is transferred between accounts. The warehouse creates group BBB for the calculated rates on this product, leaving the account identifier blank for the group. Every owner of the product shares the same calculated storage and handling rates.

The scope of a rate may be restricted to specific activities. For example, receiving handling rates should be applied to warehouse receipts only, copying and long-distance FAXing fees might apply to receiving and shipping, and extra labor might be required on any documented activity.

Applying Rates¶

A rate is used to apply charges in one of four ways:

- Repeating rates may create separate charge entries according to a calendar schedule. Repeating charges have fixed rates and quantities, so the charge is always the same. See billing documentation for more information.

- Calculated rates apply storage and handling charges to products on warehouse receipts and optionally shipments (for outbound handling), and to calculate charges for recurring product balances.

- Mandatory rates may create charges on any documents, with calculation quantities based on a broad range of options. For example, a document fee could be applied by transaction for every shipment, while a line pick fee might be applied for every line item after the third one.

- Optional rates are used to apply charges where either the occurrence, the quantity, or the rate cannot be determined programmatically. As an example, a charge for replacing a pallet shell and restacking goods would be optional, as this activity cannot be anticipated.

Only optional rates can be used when entering charges on activities, as all other rates are applied by billing calculation. Optional charges must be entered on documents prior to performing calculated billing.

Setting Up Rates¶

The Rate Setup page is divided into three sections: Identifying Information, Calculation Entries, and repeating calendars. Calendars are described separately in the billing documentation.

Identifying entries:¶

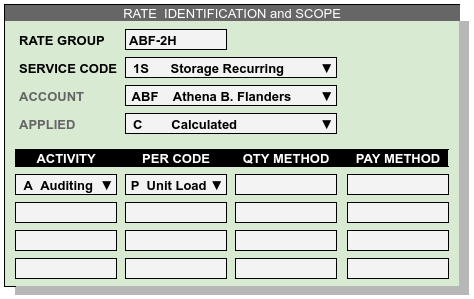

Identifying entries specify the rate grouping, the service to be performed, the account association, and the activity and billing scope of the resulting charges.

| Entry | M | Permissible Identifying Entries |

|---|---|---|

| Rate Group | M | GLOBAL, an account identifier, or a grouping code |

| Service Code | M | Selected from the list of warehouse service codes |

| Applied | M | (R)epeating, (C)alculated, (M)andatory, or (O)ptional |

| Account | A customer account, or left blank for shared groups | |

| Activity | A code for a documented activity or transaction | |

| Per Code | Code referencing quantity from transaction activity | |

| Quantity Method | O | Method reference for calculating charge quantity |

| Payer Method | O | Method to determine customer to invoice for charge |

Rates are uniquely identified by the combination of a Rate Group and a Service Code. The Rate Group entry can be either the word GLOBAL, an account identifier, or a user-defined rate group.

Service Code must be selected from the company’s Service Codes List.

Service codes determine which rates Apply as Calculated or Repeating, and the Apply code is filled and protected accordingly. Other rates should be set to Optional or Mandatory, depending on whether user entry is required to determine a charge.

Optional rates are applied through user entry, while charges for mandatory rates are created by billing calculations. Calculated rates are applied through special routines. Finally, Repeating rates create charge records and accumulate charges based on the repeating rate’s calendar schedule. Each repeating rate is associated with acalendar entry keyed by the rate’s Group and Service.

The Account entry is null for GLOBAL rates, filled with the account code for rates in an account group, and otherwise either attached to an account or blank (shared) for user-defined groups.

Each rate may restricted to apply to one or more transactional activities. Each activity has a Per code to identify the quantity calculation for the rate, and optional references to calculation methods for quantity and/or payer to invoice for the charge.

Calculation entries¶

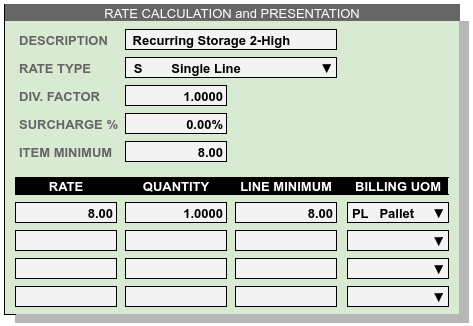

These entries determine the content of charge line detail.

| Entry | M | Billing Information Entry | Default |

|---|---|---|---|

| Description | M | Information shown on charges and invoices | (code) |

| Rate Type | M | Rate types: Single, Quantity, Measure, or Tier | S |

| Factor | M | Numerical quantity divider for unit conversion | 1.0 |

| Surcharge | Percentage charge multiplier for tax or other | null | |

| Item Minimum | Minimum total charge amount on an activity | ||

| Rate | The charge per unit of service, may be tiered | ||

| Quantity | M | Starting quantity to apply this rate tier | 1.00 |

| Line Minimum | Minimum amount for charge entry in tier | Q * R | |

| Billing UOM | M | Informational UOM used on charges and invoices |

- The rate Description entry is the actual invoice description for calculated, mandatory, and repeating charges. This is the default charge description for user-entered optional charges.

- Rate Type sets whether the rate will have a (S)ingle line, or if multiple rates form a table based on either (Q)uantity or (M)easure, or if a rate has (T)ier levels with corresponding minimums and rationality checks.

- A Factor will divide the quantity in a charge to convert from inventory quantity to billing quantity. For example, the factor 100.00 converts inventory units LB into billing UOM CW (hundredweight).

- A Surcharge percentage may apply to a rate to cover services taxes, fuel surcharges, or other items. This is a percentage, not a decimal value.

- An Item Minimum can be applied to an entire transaction to result in charges that are reasonable. For example, a handling charge of $.40 per case is not reasonable when receiving a single case.

The rates portion of an entry is tiered by quantity or measure, so that rates can increase or decrease as quantity increases.

- Where a Rate for a particular charge is variable, the Rate field may be left blank and entered manually each time the charge is applied.

- The Quantity defaults to 1.0. Quantity entries are required.

- A Minimum value for resulting charges defaults to Rate X quantity. This minimum would be applied to every transaction line.

- The Billing UOM (unit of measure) prints on charges and invoices to describe the units of a charge quantity.