Warehousing Company¶

Each Warehouse Company requires an information record to define the limitation of liability statement, to link to company addresses, and to manage message statements for warehouse receipts and other invoices.

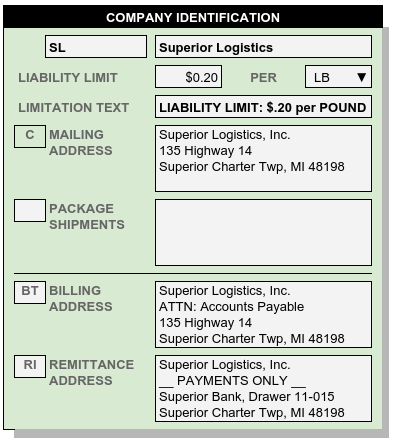

Company Identifier and Name¶

A unique company identifier must be entered to associate contact address records to the warehouse company.

Limitation of Liability¶

WARES requires entries for the Liability Limit value and Per code, which combine to produce the Liability Limit text.

Section 7-204 of the Uniform Commercial Code sets forth the warehouser’s standard of care, and allows for a limit on the amount of damages due to negligence for which he may be liable. According to the U.C.C., this limitation should be expressed per article, per item, or per weight. WARES prints a Liability Limit statement on warehouse receipts using the declared value derived from the customer account, if entered, or defaulting to the warehouse company limitation otherwise (see Account Storage).

Company Addresses¶

WARES uses between one and four contact address records for the warehouse company, based on the following specific type codes and the company identifier.

| Code | Description |

|---|---|

| C | The Company general mailing address |

| SF | The Company default shipping address |

| BT | The Company Bill To address, used for payables |

| RI | The Company remittance address, printed on invoices |

The type C address record for a warehouse is mandatory. Where another specific type of contact record is missing for the company, WARES will use the general type C address instead.

Tip

Addresses are maintained through Contacts entries. Refer to Contacts and Addresses for further information.

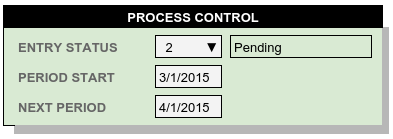

Company Process Control¶

Process Controls set features which affect the global operation of WARES. These entries include:

- Entry Status – Use this entry to set the default status applied to current records during entry. The available statuses would be 2 (allocated) or 3 (verified received/shipped), as listed in the Document Status Codes. In Billing, the Charges Calculation routine uses this status to select documents when applying calculated rates.

- Period Start – This date begins the current open accounting period for the warehouse. Transactions prior to this date are marked archived status.

- Next Period – This date begins a “future” period for billing calculations. Transactions entered to this date and beyond should not be invoiced until the current period is closed.

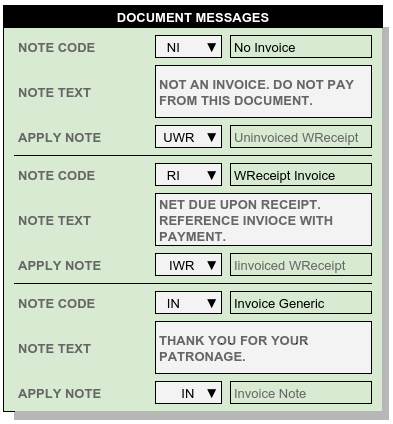

Company Invoice Messages¶

Calculating billing and producing invoices are primary functions of the WARES software. Typically a warehousing company may produce several types of charges: accessorial services on receiving and shipping, handling and storage calculated on Warehouse Receipts, recurring storage, freight and transportation, and miscellaneous services.

WARES accumulates all types of charges to produce a standard summary invoice and associated audit reports of varying levels of detail. In addition, WARES will print Warehouse Receipts as individual invoices or as documents to attach to a master invoice. Warehouse Receipts may be printed prior to accumulation to an invoice, or after an invoice for the services has been generated.

Receipts which are issued prior to invoicing should have a printed message to tell the recipient that the receipt itself is not an invoice. Invoiced receipts should state that the charges are due upon receipt, since this enforces a warehouse lein against the goods.

Document Messages allow the company to specify the exact wording for each type of invoice message. Message types for uninvoiced receipts, invoiced receipts, and standard invoices are provided in Note Application Codes, along with corresponding default message text in Note & Message Codes.